Most people who buy Bitcoin or Ethereum think they’re in it for the long run. But when the price drops 30% in a week, panic sets in. You check your portfolio. You scroll through Reddit. You hear the news. And suddenly, selling feels like the only sane choice. But what if selling is the worst thing you could do? And what if holding through the crash could make you rich? The truth is, when to HODL and when to sell isn’t about gut feelings - it’s about patterns, data, and discipline.

What HODL Really Means (And Why It’s Not Just ‘Never Sell’)

The word ‘HODL’ started as a typo. In 2013, a Bitcoin forum user named GameKyuubi posted a drunken rant titled ‘I AM HODLING’ during a market crash. He meant ‘hold,’ but the misspelling stuck. Soon, the community turned it into an acronym: ‘Hold On for Dear Life.’ And it became a philosophy.

HODL isn’t about ignoring the market. It’s about refusing to let fear make your decisions. Studies show that 85.7% of retail crypto investors lose money by trading actively. The average day trader loses 36.4% a year after fees. Meanwhile, those who bought Bitcoin in 2014 and held through every crash made over 10,000% by 2017. That’s not luck. That’s strategy.

But HODL doesn’t mean you never sell. It means you sell for a reason - not because the price dipped. You sell when your original reason for buying no longer makes sense.

When to HODL: The 3 Rules of Long-Term Holding

Not every coin deserves to be held. Here’s when you should stick with it:

- It’s Bitcoin or Ethereum. These are the only two assets with network effects strong enough to survive market crashes. Chainalysis found 94% of Bitcoin’s price rise from 2021 to 2023 came from real adoption - not speculation. Ethereum’s smart contract ecosystem is used by thousands of apps, from DeFi to NFTs. If you’re holding anything else, you’re gambling.

- You bought during fear. The best time to HODL is when everyone else is running. Look at the Crypto Fear & Greed Index. If it drops below 25 for three weeks straight, you’re in a buying window. That happened in June 2022 and December 2023. Both times, Bitcoin rallied over 90% in the next six months. Buying during panic gives you the best odds.

- You’re holding in cold storage. If your crypto is on an exchange, you’re not HODLing - you’re trusting someone else. Use a hardware wallet like Trezor or Ledger. Over 98% of long-term holders use cold storage. Only 12% of active traders do. Why? Because exchanges get hacked. And if you’re holding more than $10,000, you’re asking for trouble if you don’t.

Also, never put more than 5% of your total investment portfolio into crypto. That’s the SEC’s guideline for retail investors. If you lose it, you won’t lose your house, your savings, or your future.

When to Sell: The 4 Signs It’s Time to Exit

Even the best HODLers eventually sell. Here’s when you should too:

- The asset’s fundamentals are gone. If a project stops updating its code, loses developers, or has zero real-world use, it’s dead. Chainalysis tracked 87% of tokens that failed these three checks disappeared within 18 months. Terra/Luna was the textbook example. Thousands of HODLers lost everything because they didn’t check if the project still mattered.

- The price has doubled or tripled your original allocation. Let’s say you bought $5,000 worth of Bitcoin. If it grows to $15,000, you’ve tripled your position. That’s too risky. Use the 15/50 rule: sell 15% of any asset that’s grown 50% above your original target. This locks in profit without missing future gains.

- The market is in extreme greed. When the Fear & Greed Index hits 80+, it’s a warning. That’s when retail investors rush in, prices inflate, and whales start selling. In January 2024, the index hit 90. Bitcoin peaked at $73,000. Then it dropped 30% in three weeks. Smart sellers took profits before the crash.

- You need the money. HODLing is for wealth building, not emergency funds. If you need cash for medical bills, a house, or your kid’s tuition - sell. Don’t wait for ‘the right price.’ That’s how people get stuck in bear markets.

How Successful HODLers Sell (Without Regret)

The best sellers don’t sell all at once. They use tiered selling.

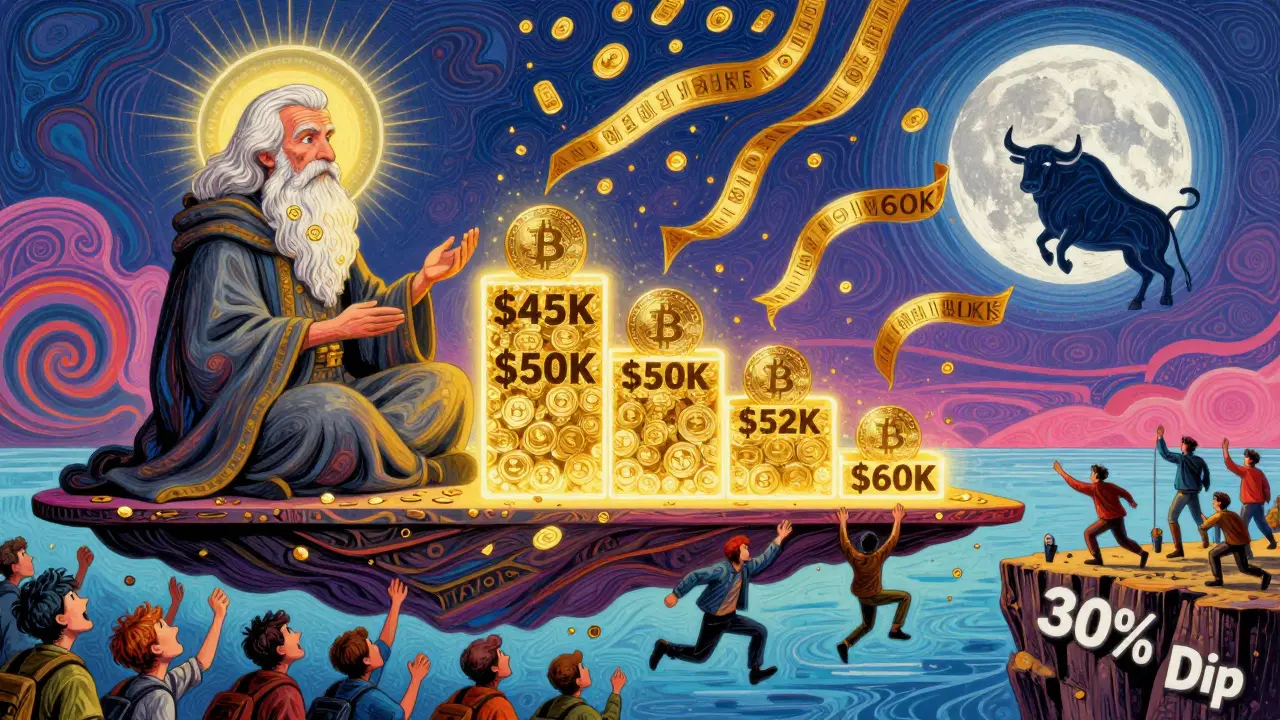

One Reddit user, u/ProfitTaker99, sold his Bitcoin in four chunks during the Q1 2024 rally:

- 50% at $45,000

- 25% at $50,000

- 15% at $52,000

- 10% at $60,000

He locked in 300% profit and still kept 10% to ride any further upside. That’s the smart way. You don’t have to choose between ‘sell everything’ and ‘never sell.’ You can do both.

Another tactic is the Bear Market Entry Protocol. Instead of buying all your Bitcoin at once, you buy in 5% increments every time the market drops 20%. This worked great in 2023. Investors who used this method got 42% better returns than those who bought in one lump sum.

What to Avoid: The 3 Deadly Mistakes

Most people lose money not because they’re wrong - but because they do these three things:

- Selling during a 30% dip. Bitcoin drops 30% every 6-8 months. If you sell every time, you’ll miss the next 100% rally. In February 2024, 74% of traders sold during a 30% correction - and regretted it within weeks.

- HODLing low-cap tokens. If a coin has a market cap under $100 million and no active developers, it’s not an investment. It’s a lottery ticket. Over 99% of HODLers in the Terra/Luna collapse lost everything. Don’t be one of them.

- Using an exchange wallet. Exchanges are not wallets. They’re banks. And banks fail. Coinbase, Binance, Kraken - they’ve all been hacked. If you’re holding more than $1,000, move it to a hardware wallet. It’s free, easy, and the only way to truly own your crypto.

Tools to Help You Decide

You don’t have to guess when to sell. Use these tools:

- Crypto Fear & Greed Index - Tells you if the market is panicked or greedy. Free at cryptofearandgreed.com.

- MVRV Z-Score - Measures if Bitcoin is overvalued. If it stays below -3.5 for 60+ days, it’s a strong sell signal. Use glassnode.com to track it.

- GitHub Activity - Check if a project is still being built. Look for at least 50 commits per month. Use github.com to search the project’s repo.

- 200-Day Moving Average - Buy when price crosses above it. It’s been a reliable signal for 10 years. Use TradingView to chart it.

Also, rebalance your portfolio every 3 months. If Bitcoin grows to 30% of your crypto holdings, sell 10% to bring it back to 15%. This keeps you from being too exposed to one asset.

The Future of HODLing

Things are changing. Binance now offers auto-compounding staking for long-term holders. You can earn 5-8% APY just by holding. TokenMetrics calls this ‘Smart HODL’ - keep 70% of your coins locked, and put 30% into yield farms. It’s a new twist on the old strategy.

Regulations are too. The EU’s MiCA rules (starting December 2024) require platforms to back every crypto asset with 130% reserves. That means fewer scams. The SEC now treats crypto held over a year as ‘long-term investments’ - meaning lower taxes.

But here’s the hard truth: crypto still has a 40% chance of permanent value destruction over 10 years, according to the Bank for International Settlements. That’s why HODLing only works if you’re selective. Bitcoin and Ethereum? Strong. Altcoins? Risky. HODLing everything? That’s not strategy - that’s wishful thinking.

Is HODLing still a good strategy in 2026?

Yes - but only for Bitcoin and Ethereum. Institutional investors now manage over $1.2 trillion using HODL strategies. ETFs like IBIT and ETHA hold zero turnover. The data is clear: long-term holders outperform traders. But HODLing low-cap altcoins is still a recipe for loss. Stick to the top two.

Should I sell if Bitcoin drops 50%?

No - unless your original reason for buying is gone. Bitcoin has dropped 50% or more six times since 2010. Each time, it eventually recovered - and then surged. Selling at a 50% loss locks in that loss. Instead, look at the 200-day moving average and the Fear & Greed Index. If both show fear, it’s a buying opportunity, not a selling one.

How long should I hold crypto before selling?

At least 18 months - preferably through a full Bitcoin halving cycle (every 4 years). Historical data shows average returns of 1,200% in the 18 months after each halving. If you hold through the next halving in 2028, you’re positioning yourself for another major rally. But don’t hold blindly - use tiered selling to lock in profits along the way.

Can I HODL and still earn passive income?

Yes. You can HODL 70% of your Bitcoin and Ethereum while staking the other 30% on platforms like Coinbase or Binance. This is called ‘Smart HODL.’ You earn 5-8% APY without selling. It’s a safer way to boost returns than trading. Just avoid staking low-cap tokens - they can collapse overnight.

What’s the safest way to store crypto for HODLing?

Use a hardware wallet - Trezor Model T or Ledger Nano X. These keep your private keys offline. Over 98% of long-term holders use them. If you’re holding more than $10,000, use a multisignature wallet. Single-signature wallets were behind 99.3% of all crypto thefts in 2024. Don’t leave crypto on exchanges - they’re not safe.

Is it better to HODL or trade crypto?

For 85.7% of people, HODLing is better. A University of California study tracked 4,228 traders over five years. Active traders lost 36.4% annually on average. HODLers made 22.1% annually. Trading requires skills most people don’t have - and emotional control most people lack. If you’re not a full-time trader, HODLing is the smarter choice.

Final Thought: HODL With Your Eyes Open

HODLing isn’t about blind faith. It’s about patience, discipline, and knowing what to ignore. The market will scare you. The news will panic you. Your friends will tell you to sell. But if you’re holding Bitcoin or Ethereum, bought during fear, stored safely, and monitored with data - you’re doing it right.

Sell when the fundamentals die. Sell when the price has doubled your allocation. Sell when you need cash. But don’t sell because the price dipped. That’s how you lose.

The next bull run is coming. The question isn’t whether you’ll be in it. The question is - will you be holding… or selling?