When you hear about a new crypto project promising 10x returns, you might feel excited. But behind the hype, there’s a dark side: rug pulls. These aren’t just bad investments-they’re deliberate scams where developers vanish with your money. And while both token and NFT rug pulls look similar on the surface, they work in completely different ways. Knowing the difference isn’t just helpful-it could save you thousands.

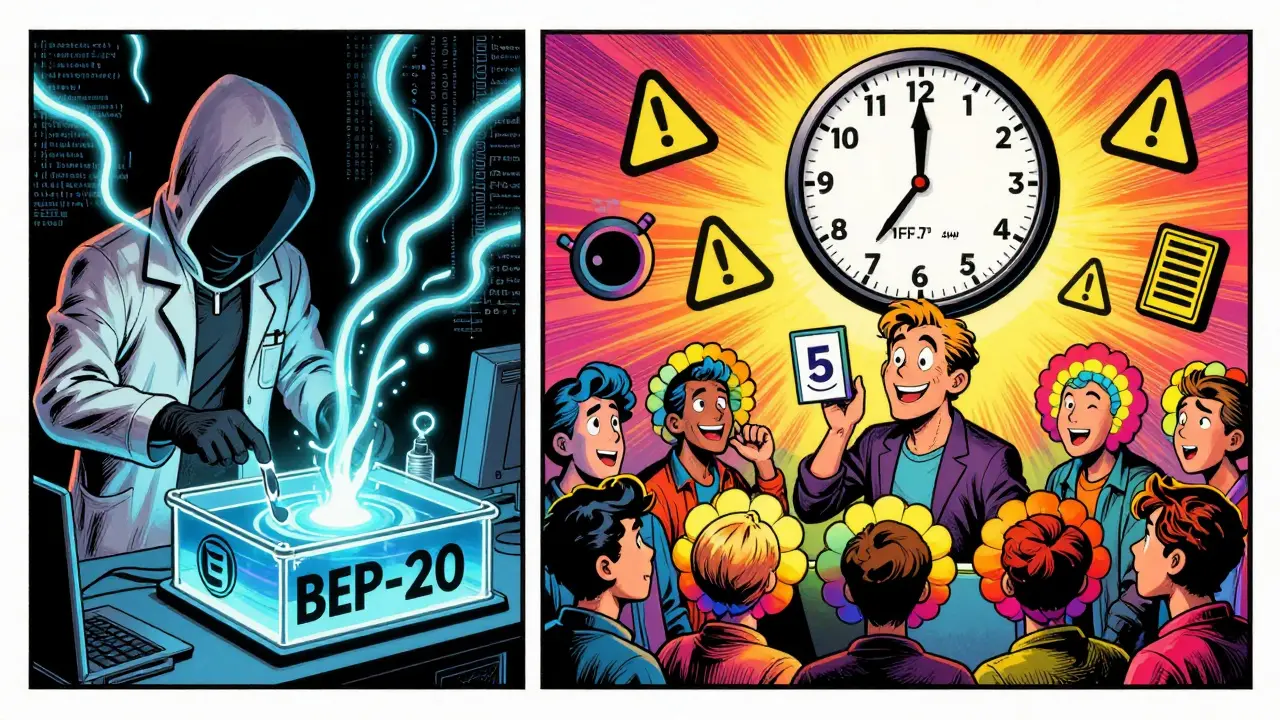

How Token Rug Pulls Work

Token rug pulls target fungible tokens like ERC-20 or BEP-20 coins. The scam starts with a simple setup: developers create a token, pair it with ETH or BNB on a decentralized exchange like Uniswap or PancakeSwap, and then pump it with fake hype. They use Twitter influencers, Telegram groups, and trending hashtags to make it look legit. Once enough people buy in and lock liquidity into the pool, the devs pull the plug. The most common method? Liquidity draining. In 62% of cases, the team removes all the ETH or BNB from the liquidity pool. Without liquidity, the token becomes unsellable. You can’t trade it. You can’t exit. And it drops to zero instantly. The infamous SQUID token in 2021 did exactly this-surging 2,400% in a day before crashing. Investors lost over $3 million in hours. But it’s not always that obvious. Some tokens use hidden smart contract tricks. Honeypots prevent you from selling. Hidden mints let devs create unlimited tokens. Fake ownership renunciations make it look like they gave up control-when they haven’t. And sell fees? Some tokens charge 100% fees when you try to sell. That’s not a bug. That’s the plan. These scams move fast. From launch to collapse, the average token rug pull takes just 3.2 days. Automated tools like RPHunter catch 92% of them, but many slip through, especially on Binance Smart Chain where oversight is weaker. Solidus Labs found 12% of BEP-20 tokens have malicious code built in. That’s one in eight.How NFT Rug Pulls Work

NFT rug pulls don’t need to drain liquidity. They don’t even need to hack a contract. They just need to lie-and keep lying. Instead of a token you can trade, you’re buying a digital image. But the real value isn’t the image. It’s the promise: “Buy this NFT and get access to our metaverse game,” or “Hold this and you’ll get airdrops,” or “We’re partnering with major brands.” Then, nothing happens. The most common NFT rug pull? Promised utility abandonment. In 78% of cases, developers never deliver what they sold. You bought a “Bored Ape clone” expecting a playable game. Instead, you got a JPEG and a dead Discord server. The Blur Finance NFT project in March 2023 vanished with $600,000 in community funds after deleting every social account. NFT rug pulls are slower. They take 30 to 90 days to unfold. First, they build hype. Then, they manipulate floor prices-buying their own NFTs to make it look popular. They post fake roadmap updates. They hire moderators to answer questions. They even use deepfake videos of fake founders. By the time you realize it’s a scam, the team is gone, and the NFTs are worth pennies. Unlike token rug pulls, NFT scams rarely use smart contract exploits. They rely on trust. And that’s harder to detect. Automated tools struggle because they can’t tell if a roadmap is fake. They can’t see if a team is anonymous. They can’t hear the silence when the Discord goes quiet.Key Differences Between Token and NFT Rug Pulls

| Aspect | Token Rug Pull | NFT Rug Pull |

|---|---|---|

| Primary Method | Liquidity pool draining | Broken promises and abandoned roadmaps |

| Execution Speed | 1-7 days (avg. 3.2 days) | 30-90 days (avg. 56.7 days) |

| Technical Complexity | High (smart contract manipulation) | Low (social engineering) |

| Detection Difficulty | Easier (automated tools catch 92%) | Harder (no reliable automated detection) |

| Typical Victim Loss | 95-100% within hours | 85% over 30 days |

| Common Red Flags | Hidden sell fees, locked liquidity, anonymous team | Unrealistic roadmap, no code repo, cloned art |

| Recovery Chance | 8% (via community action) | 23% (via community pressure) |

Token rug pulls are like a bank robbery-fast, brutal, and obvious after the fact. NFT rug pulls are more like a con artist building a relationship over months, then disappearing with your savings. One is technical. The other is psychological.

How to Spot a Rug Pull Before It Happens

You don’t need to be a coder to protect yourself. Here’s what to look for:- For tokens: Check the liquidity pool. Is it locked? Use tools like RugDoc.io or TokenSniffer. If the team renounced ownership, verify it on Etherscan. If the contract has a max sell limit under 1%, it’s likely a honeypot.

- For NFTs: Look at the roadmap. Is it vague? Does it say “more details coming”? That’s a red flag. Check if the team is doxxed. If the GitHub repo is empty or just a placeholder, walk away. Are the NFTs cloned from Bored Apes or CryptoPunks? That’s a 90% chance of a scam.

Don’t trust influencers. Look at the community. Are people asking hard questions? Are moderators deleting comments? Is the Discord full of bots? If the team has 50,000 followers but only 50 active members, it’s a ghost town.

And never invest more than you can afford to lose. Even the best tools can’t catch every scam. The goal isn’t to find the next 100x- it’s to avoid losing everything.

Why Recovery Is Almost Impossible

You might think, “If I get scammed, I’ll report it.” But here’s the truth: crypto is decentralized. There’s no central bank. No customer service line. No refund policy. Token rug pull victims report a 97% failure rate in recovering funds. NFT victims have a slightly better shot-23% recover something through community pressure. But that’s rare. Most NFT scams involve anonymous teams using burner wallets and cross-chain bridges to hide the money. Chainalysis found that 40% of NFT rug pull funds are moved across multiple chains before vanishing. Regulators are starting to act. The SEC has fined teams behind token rug pulls like SQUID. But NFTs? Only three enforcement actions since 2022. Why? Because NFTs are treated as collectibles, not securities. That legal gray area lets scammers hide.

What’s Changing in 2025

Rug pulls aren’t slowing down-they’re getting smarter. In 2024, 17% of token scams used AI-generated marketing videos. NFT scams now use deepfake founders. And the biggest threat? Hybrid rug pulls. These are projects that combine tokens and NFTs. You buy an NFT, and it gives you access to a token. The devs drain the token’s liquidity, then abandon the NFT. According to ACM Digital Library, these hybrid scams will make up 35% of all rug pulls by 2025. Exchanges are waking up. 23% now use automated rug pull detection. But NFT marketplaces? Only 14%. That means you’re on your own when buying NFTs.Final Advice: Protect Yourself

If you’re new to crypto, stick to well-known projects. Bitcoin. Ethereum. Even established DeFi platforms like Uniswap or Aave. Avoid anything with “100x” in the name. Avoid anything with a fake team photo. Avoid anything that asks you to connect your wallet before you’ve done your homework. Use free tools: RugDoc.io for tokens, RaritySniper for NFTs. Join Reddit communities like r/CryptoScams and r/NFTFraud. Read the horror stories. They’re not exaggerations-they’re real people who lost their rent money. Crypto is full of opportunity. But it’s also full of predators. The difference between profit and loss isn’t luck. It’s awareness.Can you recover money after a rug pull?

Recovery is extremely rare. For token rug pulls, less than 8% of victims get any money back, usually through community pressure or legal action against doxxed developers. NFT rug pulls have a slightly higher recovery rate (23%) because victims sometimes organize to pressure the team or reclaim assets through NFT marketplaces. But in most cases, the funds are moved across multiple blockchains and wallets, making tracing nearly impossible. There is no central authority to appeal to.

Are all NFTs scams?

No. Many legitimate NFT projects exist-like Art Blocks, CryptoPunks, and verified collections from established artists. The problem is that scams are designed to look exactly like them. Look for doxxed teams, active development, real utility, and transparent roadmaps. If the project has no code repository, no team names, and only promises future features, it’s likely a scam.

How do I check if a token is a honeypot?

Use tools like RugDoc.io or TokenSniffer. They analyze the smart contract for hidden functions. Look for these red flags: sell transactions blocked, max transaction limits set below 1%, or ownership not renounced. You can also manually check the contract on Etherscan or BscScan-if the owner address can still mint tokens or change fees, it’s a honeypot.

Why are NFT rug pulls harder to detect than token rug pulls?

Token rug pulls rely on code vulnerabilities that automated scanners can spot-like hidden sell fees or liquidity drains. NFT rug pulls exploit trust and promises, not code. There’s no algorithm that can tell if a “metaverse game” will ever be built. You have to read the roadmap, check the team’s history, and monitor community activity. That’s human judgment, not machine detection.

Is it safe to invest in new tokens with high APYs?

Almost never. High APYs are a classic red flag. They lure people in with the promise of passive income, but they’re often designed to attract liquidity that will be drained. Real DeFi projects don’t need to pay 500% APY-they earn through fees and usage. If it sounds too good to be true, it is. Always check the token’s liquidity, team, and contract before investing.

What’s the difference between a rug pull and a pump and dump?

A pump and dump involves a group inflating a price and selling off, but the project may still exist afterward. A rug pull is a total scam-the project is fake from the start. The devs never intended to build anything. They just wanted your money. In a pump and dump, you might still hold a token. In a rug pull, the token is worthless and unsellable.

Kayla Murphy

December 17, 2025 AT 05:53This post is so important right now-I’ve seen so many friends lose everything chasing 10x gains. Just last week, someone I know bought into a ‘next-gen metaverse NFT’ and now their wallet’s just a ghost town. Don’t let FOMO blind you. Take a breath. Do the work.

Bradley Cassidy

December 19, 2025 AT 04:14bro i just lost my rent money on some token called $BANANAPEE that had a dog in a spacesuit as the logo 😭 i thought it was cute. turns out the dev’s github was just a single README.md that said ‘lol u got pwned’. now i’m too scared to even look at crypto anymore. anyone got a safe project to recommend? i just wanna chill and maybe make 2x, not get rug-pulled into oblivion.

SeTSUnA Kevin

December 19, 2025 AT 13:06The distinction between token and NFT rug pulls is technically accurate but semantically redundant. Both are manifestations of asymmetric information exploitation in unregulated speculative markets. The real issue is the normalization of zero-knowledge investment.

Florence Maail

December 21, 2025 AT 05:01lol they said 'AI-generated marketing videos'... but did they mention the government is secretly behind most rug pulls to push people into CBDCs? 🤔 I’ve seen the patterns-every time someone gets burned, the SEC 'accidentally' leaks a new regulation. Coincidence? I think not. 💀

Dionne Wilkinson

December 22, 2025 AT 04:26I used to think crypto was about innovation. Now I think it’s about human nature-how easily we trade hope for hype. I don’t blame the scammers. I blame the system that tells us wealth is just one click away. Maybe the real rug pull isn’t the contract-it’s the belief that we deserve to get rich without risk.

Rebecca Kotnik

December 24, 2025 AT 03:03While the article provides a thorough comparative analysis of token and NFT rug pulls, one must consider the broader socio-economic context in which these phenomena emerge. The proliferation of decentralized finance has outpaced regulatory infrastructure, creating fertile ground for opportunistic exploitation. Moreover, the psychological appeal of decentralized autonomy often masks the underlying centralization of influence-where a handful of anonymous actors control liquidity, narrative, and exit strategy. The tools cited-RugDoc.io, TokenSniffer-are valuable, yet they remain reactive rather than preventative. A structural solution requires not just individual vigilance, but collective institutional accountability, which remains conspicuously absent in the current paradigm.

Craig Nikonov

December 25, 2025 AT 18:51Hybrid rug pulls are just the beginning. Wait till you see the ones where the NFT is a QR code that links to a fake wallet. They’ll make you connect it, then drain your ETH and burn the NFT. All while the Discord says ‘coming soon!’ 😏

Jack Daniels

December 27, 2025 AT 02:48I used to think I was smart. Then I bought an NFT called ‘CryptoCats’ that promised me a real cat. I got a JPEG. The Discord went silent. I haven’t slept since.

Kelsey Stephens

December 28, 2025 AT 13:39Bradley, I feel you. I’ve been there too. It’s okay to feel stupid-it means you’re still learning. Start small. Try a project with a real team, even if it’s just a $5 NFT from someone who posts their face and their GitHub. You’ll start to recognize the vibe. And you’re not alone. We’re all figuring this out together.

Mark Cook

December 30, 2025 AT 13:04Wait-so you’re telling me the entire crypto space isn’t just a government-run simulation to test human gullibility? 🤨 I knew it. This post is obviously a distraction. Where’s my quantum blockchain wallet? 🚀