Crypto Fee Calculator

Calculate Your Fees

Fee Comparison Results

Your estimated fees:

Savings compared to Nexus Trade

What this calculator shows

Based on the article review, Nexus Trade charges a flat 0.22% fee for both maker and taker trades, while Binance charges 0.1% for standard trades. This calculator helps you understand the cost differences over time.

With $1,000 in trades, you'd pay:

- Nexus Trade: $2.20

- Binance: $1.00

- Coinbase: $6.00

While Nexus Trade's flat fee structure is simple, it's not the cheapest option. Over time, those extra fees can add up significantly.

When you're new to crypto, you don't need a dozen trading tools. You just want to buy Bitcoin without getting lost in a maze of charts and complex fees. That’s the promise of Nexus Trade - a crypto exchange launched in 2024 that markets itself as simple, cheap, and beginner-friendly. But simplicity shouldn’t mean sacrificing safety or functionality. After digging into its features, user reports, and security practices, here’s the real story.

What Nexus Trade Actually Offers

Nexus Trade is a web-only crypto exchange that only supports spot trading. That means you can buy and sell cryptocurrencies like Bitcoin and Ethereum at current market prices. You can’t short, leverage, or set stop-loss orders. If you’re looking to day trade or hedge your positions, this platform won’t help you. It supports 63 trading pairs - a tiny fraction compared to Binance’s 1,000+. You’ll find major coins (BTC, ETH, SOL), stablecoins (USDT, USDC), and some fiat pairs like USD, EUR, and GBP. But if you want to trade obscure altcoins, you’ll be disappointed. The interface is clean. No cluttered dashboards. No confusing menus. That’s a win for beginners. You can deposit fiat via bank transfer or credit card, or send crypto directly. The minimum deposit is $20 - lower than eToro’s $200, but higher than Robinhood’s $1. It’s accessible, but not groundbreaking.Fees: Flat 0.22% - Simple, But Not the Cheapest

Nexus Trade charges a flat 0.22% fee for both maker and taker trades. No tiers. No volume discounts. No hidden charges. That’s easy to understand. But here’s the catch: Binance charges 0.1% for standard trades, and you can drop it even lower with BNB holdings. Coinbase charges 0.6%. So Nexus Trade isn’t the cheapest - it’s just the most straightforward. If you trade $1,000 a month, you’ll pay $2.20 in fees. On Binance, you’d pay $1. That’s not a huge difference, but over time, it adds up.The Nexus Vault: Low Returns, Questionable Safety

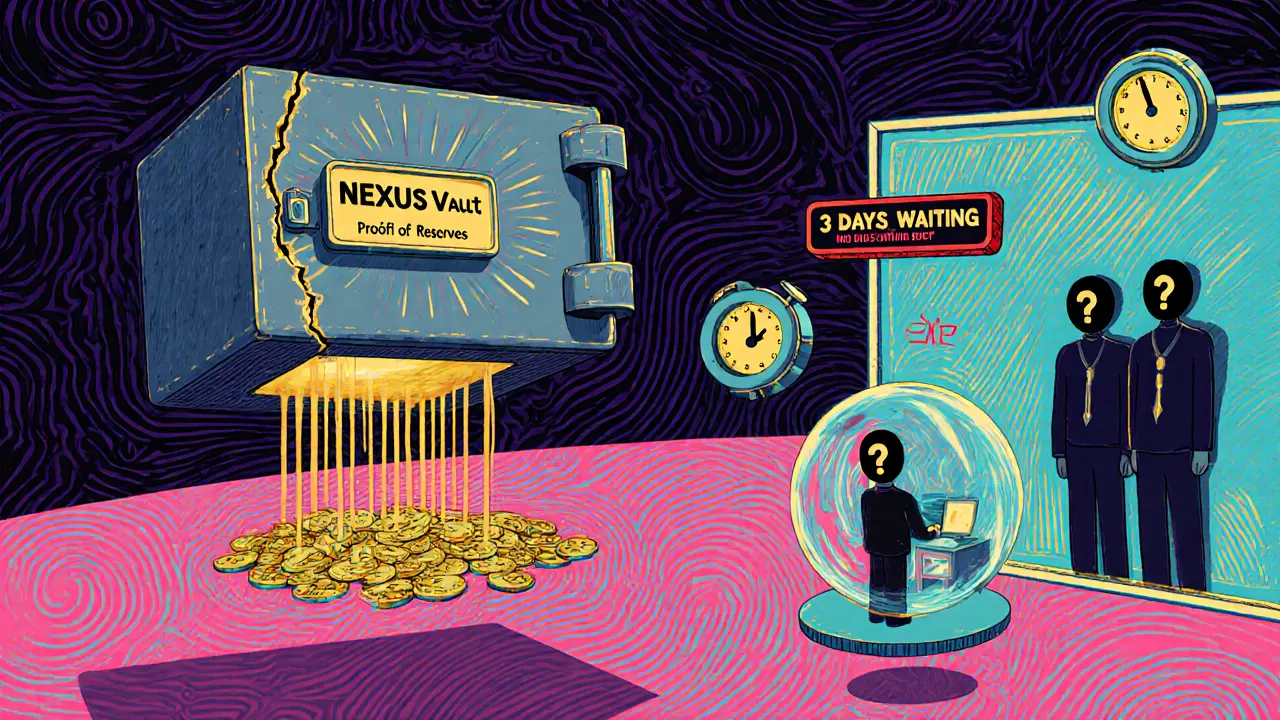

Nexus Trade’s main gimmick is the Nexus Vault - a passive earnings program that pays interest on your crypto holdings. Rates range from 2.5% to 4.5% APY, depending on the asset. Stablecoins like USDT earn around 3.8%. That’s not terrible. But compare it to what was available before the 2022 crypto crash: Celsius offered 8%, BlockFi paid 9%. Even today, Nexo gives up to 12% for loyal users. The bigger issue? There’s no proof Nexus Trade is actually holding your coins securely. No published proof-of-reserves. No cold storage percentage disclosed. No third-party audit. That’s a red flag. If the platform gets hacked or goes under, your interest payments vanish - and so does your principal.No Mobile App? That’s a Dealbreaker for Most

Nexus Trade has no mobile app. None. Not for iOS. Not for Android. You can only trade through a web browser. In 2025, that’s almost unheard of. Over 98% of the top 20 crypto exchanges have apps. Coinbase, Binance, Kraken - all have polished, feature-rich mobile platforms. You can check prices, send crypto, and even set alerts on your phone. Nexus Trade forces you to sit at a computer. If you’re traveling, commuting, or just away from your desk, you’re locked out. That’s a major limitation for anyone who doesn’t live at their desk.

Security: Basic at Best

The platform uses SSL encryption and two-factor authentication (2FA). That’s standard. But beyond that? Nothing. No bug bounty program. No public security roadmap. No details on how funds are stored. Kraken keeps 95% of assets in cold storage. Coinbase gets audited quarterly. Nexus Trade says nothing. Security expert Dr. Evelyn Reed from Decrypt called it a “significant risk factor.” That’s not hyperbole. In crypto, you’re trusting a company with your money. If they won’t tell you how they protect it, why should you trust them?Customer Support: Slow and Silent

Support is only available through a ticket system. No live chat. No phone. No Discord. No Twitter response team. Users report waiting 3 to 4 days for replies. One Reddit user submitted a withdrawal issue on March 5 and didn’t hear back until March 28. That’s over three weeks for a problem that could cost you money. Compare that to Coinbase, where support responds in under 24 hours. Or Binance, which has 24/7 live chat. Nexus Trade treats customer service like an afterthought.Liquidity and Slippage: Thin Order Books

Nexus Trade’s 24-hour trading volume is $14.3 million. That’s 0.00007% of the entire crypto market. For context, Binance does over $28 billion in the same time. Why does this matter? Thin order books mean slippage. If you try to buy $5,000 worth of Bitcoin, the price might jump 1.7% before your order fills. That’s a $85 loss on a single trade - just because the market is too shallow. Active traders avoid platforms like this. You can’t scalp, swing trade, or even dollar-cost average effectively when prices move unpredictably during execution.

Who Is Nexus Trade For?

This exchange isn’t for traders. It’s for people who want to buy crypto and hold it. Simple. No frills. If you’re a beginner who:- Wants to buy Bitcoin or Ethereum without being overwhelmed

- Prefer flat fees over complex tier systems

- Has $20 to start and doesn’t need leverage

- Is okay with waiting days for support

- Doesn’t need a mobile app

- Want to trade actively

- Need to move money quickly

- Value security transparency

- Use your phone to manage finances

- Plan to hold more than $1,000

The Bigger Picture: Is Nexus Trade Here to Stay?

Nexus Trade operates in a regulatory gray zone. No clear licensing in the U.S., EU, or Singapore. No public funding announcements. No team names. No office address. Industry analysts at Messari rate it “high risk.” Delphi Digital says it lacks the funding or differentiators to survive long-term. The crypto exchange market is consolidating. Binance, Coinbase, Kraken - they’re getting bigger. Smaller players either get bought, shut down, or fade away. Nexus Trade hasn’t released a major update since January 2025. No new features. No partnerships. No marketing push. That’s not the behavior of a company planning to grow.Final Verdict: A Niche Tool, Not a Safe Haven

Nexus Trade isn’t a scam. But it’s not a safe or smart long-term home for your crypto. It’s a low-cost, no-frills gateway for absolute beginners who just want to dip their toes in. If you’re using it to buy $50 of Bitcoin and hold it for years? Fine. But don’t store your life savings here. The lack of mobile access, weak security disclosures, slow support, and thin liquidity make it a risky bet for anyone serious about crypto. There are better options - even for beginners. If you want simplicity with security, try Coinbase. If you want low fees and apps, use Binance. If you want passive income with better rates and transparency, look at Kraken or Gemini. Nexus Trade has a place - but it’s not at the center of your crypto strategy. It’s a side door. Use it cautiously, and don’t stay long.Is Nexus Trade safe to use?

Nexus Trade uses basic security like SSL and 2FA, but it doesn’t disclose how much of user funds are in cold storage, doesn’t publish proof-of-reserves, and has no third-party audits. That’s a major red flag. While it’s not confirmed as a scam, the lack of transparency makes it riskier than regulated exchanges like Coinbase or Kraken. Don’t store large amounts here.

Does Nexus Trade have a mobile app?

No, Nexus Trade has no mobile app for iOS or Android. It’s a web-only platform. This makes it inconvenient for anyone who wants to check prices, send crypto, or make trades on the go. Most top exchanges offer apps - Nexus Trade does not, which limits its usability significantly.

What are the fees on Nexus Trade?

Nexus Trade charges a flat 0.22% fee for both maker and taker trades. There are no volume discounts or tiered pricing. While this is simple to understand, it’s not the cheapest. Binance charges 0.1% for standard trades, and you can reduce it further with BNB. Coinbase charges 0.6%. Nexus Trade is mid-tier in cost - simple, but not the best value.

How good is Nexus Trade’s customer support?

Support is only available via ticket system - no live chat, no phone, no email. Users report response times of 3 to 4 business days, and some have waited over three weeks for replies. This is far slower than industry leaders like Coinbase, which responds within 24 hours. If you need quick help, Nexus Trade is not the right choice.

Can I earn interest on Nexus Trade?

Yes, through the Nexus Vault program. You can earn between 2.5% and 4.5% APY on supported assets, with stablecoins like USDT earning around 3.8%. While this is better than nothing, it’s lower than what platforms like Nexo or Kraken offer. More importantly, there’s no insurance or proof that your funds are safe if the platform fails.

Is Nexus Trade regulated?

No, Nexus Trade is not licensed in the U.S., EU, or any major jurisdiction. It operates without clear regulatory oversight. This means users have no legal protections if something goes wrong. Regulated exchanges like Coinbase are required to follow strict rules on fund storage, audits, and customer protection - Nexus Trade is not.

What’s the minimum deposit on Nexus Trade?

The minimum deposit is $20. This makes it accessible for beginners with limited funds. It’s lower than eToro’s $200 minimum, but higher than Robinhood Crypto’s $1. While low, it’s not the lowest available - and it doesn’t compensate for the platform’s other limitations.

Does Nexus Trade offer leverage or margin trading?

No. Nexus Trade only offers spot trading. You cannot borrow funds to trade with leverage, set stop-loss orders, or use advanced order types. This makes it unsuitable for active or professional traders who rely on these tools to manage risk and maximize returns.

Should I use Nexus Trade instead of Binance or Coinbase?

Only if you’re a complete beginner who wants to buy a small amount of crypto and hold it long-term, and you don’t mind waiting days for support or being locked out of your account without a computer. For everyone else - especially those holding more than $500 - Binance, Coinbase, or Kraken are far safer, more functional, and more reliable choices.

What are the biggest risks of using Nexus Trade?

The biggest risks are: 1) No transparency around security or fund storage, 2) No mobile app limiting access, 3) Slow customer support that can delay withdrawals, 4) Thin order books causing high slippage on trades, and 5) No regulatory oversight. These factors combine to make Nexus Trade a high-risk option for anyone serious about crypto.

Savan Prajapati

November 27, 2025 AT 03:29This platform is a trap for newbies who think 'simple' means safe. No app? No audits? You're literally gambling with your Bitcoin and calling it 'convenient.' Wake up.

Michael Labelle

November 28, 2025 AT 17:32I tried Nexus Trade last month just to buy a little BTC. The interface was clean, sure-but when I tried to withdraw $50, it took 11 days. No updates. No explanation. I switched to Kraken. Worth the steeper fee for peace of mind.

Joel Christian

November 28, 2025 AT 18:45ok so i read this whole thing and like… no mobile app?? like wtf?? and 0.22% fee?? i thought this was supposed to be cheap?? also why no proof of reserves?? this feels like a sketchy side hustle not a real exchange… lol

jeff aza

November 29, 2025 AT 20:45Let’s be precise: Nexus Trade’s 0.22% fee structure is functionally regressive for micro-traders; it lacks volume-based disincentives for high-frequency activity, which fundamentally misaligns with modern liquidity provisioning models. Moreover, the absence of a mobile SDK-combined with non-disclosure of custodial architecture-creates a non-compliant risk surface under MiCA and SEC guidance. This isn’t ‘beginner-friendly’-it’s a regulatory liability dressed as a UX win.

Vijay Kumar

December 1, 2025 AT 12:52You think this is bad? Wait till you see how people treat their crypto like a lottery ticket. Nexus Trade is perfect for them-because they don’t care about security. They just want to see the green candle. Sad, but true.

Vance Ashby

December 1, 2025 AT 23:51Yea but… like… I just want to buy BTC and chill 😅 no need for all the fancy apps and audits. If it works, it works. 0.22% is fine for me. I’m not trading 24/7. And if I need help? I’ll wait. 🤷♂️

Brian Bernfeld

December 2, 2025 AT 19:42Look-I get why people are drawn to Nexus Trade. It’s clean, it’s simple, it doesn’t overwhelm you. But here’s the truth: crypto isn’t just about buying. It’s about protecting. And if you’re not asking ‘Where are my coins?’ before you deposit, you’re already behind. I’ve seen too many people lose everything because they trusted a ‘simple’ platform with no transparency. If you’re serious-even a little-go to Kraken or Coinbase. They’ve got apps, audits, support, and real security. Nexus Trade? It’s a gateway drug to crypto… and you’ll want to move on before it bites you.