Liquidity Risk Calculator

Your Trade Details

Estimated Impact

Enter trade details to see potential losses

Mars Ecosystem Crypto Exchange Review: Is This Decentralized Exchange Worth Your Time?

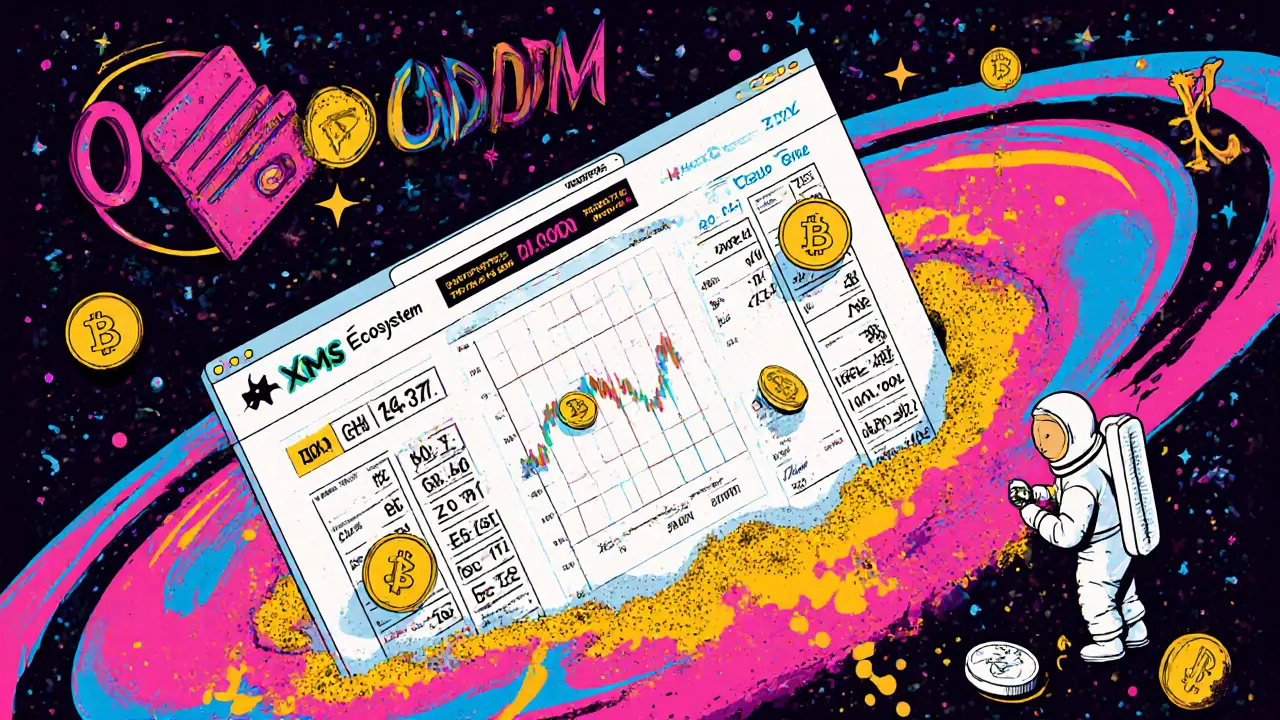

If you're looking for a new crypto exchange to trade on, you’ve probably seen Mars Ecosystem pop up in search results. It promises decentralized trading, its own stablecoin called USDM, and a native token named XMS. But here’s the reality: Mars Ecosystem isn’t just small-it’s nearly invisible in the crypto world.

As of November 2025, this platform reports a 24-hour trading volume of just $744.13. That’s less than the cost of a decent laptop. For comparison, Binance trades over $10 billion in the same time. Even smaller DEXs like PancakeSwap or Uniswap move hundreds of millions daily. Mars Ecosystem doesn’t just trail behind-it’s not even in the same race.

What Mars Ecosystem Actually Offers

Mars Ecosystem operates as a decentralized exchange (DEX), meaning you trade directly from your wallet without handing over your keys. It supports only five cryptocurrencies and seven trading pairs. The most active pair is XMS/WBNB, which accounts for over half of all trading volume on the platform. That’s a red flag on its own. A healthy exchange should have multiple liquid pairs-not one dominating everything.

The platform’s main selling point is its stablecoin, USDM. According to its documentation, transaction fees from Mars Swap (its built-in liquidity pool) are used to back USDM’s value. Sounds smart, right? But here’s the catch: no one’s trading USDM. Without real demand and volume, a stablecoin is just a number on a screen. It can’t hold its peg if nobody uses it.

There’s no margin trading, no futures, no staking rewards, and no API for developers. If you’re looking for advanced features, you won’t find them here. This isn’t a platform for traders-it’s a prototype with no users.

Zero Traffic, Zero Trust

Mars Ecosystem’s website gets about 81 visits per month. That’s fewer than a local coffee shop gets on a Tuesday afternoon. Of those visits, 40% leave immediately. The average user views just over one page and then exits. That’s not user behavior-it’s ghost traffic.

Compare that to even obscure exchanges like CoinEx or BitMart, which still pull in thousands of daily visits. Mars Ecosystem doesn’t rank in the top 500 crypto exchanges by traffic. It sits at #506 out of 612. That’s not niche. That’s irrelevant.

There are no reviews on Trustpilot, Sitejabber, or Reddit. No YouTube tutorials. No active Discord or Telegram groups. No blog posts. No news coverage from Cointelegraph, Decrypt, or The Block. If a crypto project has no community, no documentation, and no buzz, it’s not a project-it’s a placeholder.

Security and Regulation: A Major Red Flag

Mars Ecosystem is not regulated by any government authority. Not the SEC. Not the FCA. Not any EU or UK body. That means if your funds disappear, you have zero legal recourse. No one is auditing its smart contracts publicly. No one is publishing security reports. No one is answering questions about how user assets are protected.

And here’s the worst part: there’s already a scam project called “The Big Mars” running a fake 5000BTC giveaway. The names are similar. The websites look alike. People searching for Mars Ecosystem could easily land on the scam site by accident. That’s not a coincidence-it’s a danger.

Without regulation, transparency, or audits, this exchange operates in the dark. And in crypto, darkness doesn’t mean privacy-it means risk.

Liquidity Is Nonexistent

Liquidity is the lifeblood of any exchange. Mars Ecosystem’s order book depth ranks in the 13th percentile among all crypto exchanges. That means if you try to trade even $100 worth of XMS, you’ll likely get a terrible price because there’s no one on the other side of the trade.

Slippage-the difference between the price you see and the price you get-is probably over 5% on most trades. That’s not trading. That’s gambling. You could lose 10% of your investment just by hitting “buy” because the market is too thin to absorb your order.

Even the bid-ask spread-a measure of market efficiency-is 0.715%. That’s higher than most centralized exchanges charge for trading fees. You’re paying more to trade, and getting worse prices, on a platform with almost no users.

What About the XMS Token?

The XMS token trades at around $0.00037. That’s a fraction of a cent. It’s not a currency. It’s not a store of value. It’s a speculative asset with no utility beyond the platform’s own ecosystem.

There’s no burn mechanism. No staking rewards. No governance voting. No partnerships. No real-world use case. The only reason it has any value is because someone bought it on Mars Ecosystem-and even then, it’s mostly just the same few wallets trading back and forth.

If you’re thinking of buying XMS because it’s “cheap,” remember: low price doesn’t mean high potential. It just means low demand. And low demand means low liquidity. And low liquidity means you’ll be stuck with it.

Who Is This Exchange For?

Let’s be clear: Mars Ecosystem is not for traders. It’s not for investors. It’s not for developers. It’s not even for curiosity.

If you’re looking to:

- Trade crypto reliably

- Use a stablecoin you can trust

- Access a secure, regulated platform

- Find community support or help when things go wrong

-then this is not the place.

There are no success stories. No case studies. No testimonials. Just a website with a few numbers on a chart and a whitepaper that no one reads.

Alternatives That Actually Work

If you want a decentralized exchange with real volume, real liquidity, and real security, try these instead:

- Uniswap - The largest DEX on Ethereum, with over $1 billion daily volume.

- PancakeSwap - The top DEX on BNB Chain, with strong community and frequent updates.

- Curve Finance - Best for stablecoin swaps with minimal slippage.

- Bybit or KuCoin - If you want centralized options with regulation and customer support.

These platforms have audits, customer service, active communities, and millions of users. They’re not perfect-but they’re real. Mars Ecosystem isn’t even close.

The Bottom Line

Mars Ecosystem isn’t a failed exchange. It’s an abandoned one.

With less than $1,000 in daily trading volume, zero regulatory oversight, no user base, and no community, it has no future. The project may have launched in 2021 with big ideas, but it never gained traction. And in crypto, if you don’t grow, you die.

Don’t waste your time or money on this platform. Even if you think you’re getting in early, you’re just giving your funds to a ghost.

If you’re new to crypto, start with a trusted exchange. If you’re experienced, stick to platforms with real volume and transparency. Mars Ecosystem doesn’t offer either.

Is Mars Ecosystem a scam?

Mars Ecosystem isn’t officially listed as a scam by major watchdogs, but it shares many red flags with fraudulent projects: zero traffic, no regulation, no community, and no transparency. The existence of a similarly named scam site (The Big Mars) makes it even riskier. While not confirmed as fraudulent, it’s far too risky to trust with your funds.

Can I make money trading XMS on Mars Ecosystem?

Technically, yes-but only if you’re lucky. With a 24-hour trading volume under $1,000, liquidity is almost nonexistent. Even small trades cause massive slippage. You’re more likely to lose money on fees and poor pricing than to profit. XMS has no real utility, and no one outside the platform is interested in it.

Is USDM a reliable stablecoin?

No. USDM claims to be backed by transaction fees from Mars Swap, but with virtually no trading activity, there’s no real backing. A stablecoin needs real demand, real reserves, and real audits to hold its value. USDM has none of these. It’s a theoretical concept with no practical foundation.

Why does Mars Ecosystem have such low traffic?

Because no one trusts it. No one knows about it. And no one needs it. There are no marketing campaigns, no partnerships, no influencers promoting it, and no user reviews. It’s a platform with no audience. In crypto, visibility and trust drive adoption. Mars Ecosystem has neither.

Should I connect my wallet to Mars Ecosystem?

No. Connecting your wallet to an unregulated, low-traffic DEX like Mars Ecosystem exposes you to potential smart contract exploits, front-running, and phishing risks. Even if your funds aren’t stolen, you’ll likely lose money due to poor liquidity. There’s no reason to risk it when better, safer options exist.

What happened to Mars Ecosystem after its launch?

After launching in 2021, Mars Ecosystem failed to attract users, liquidity, or media attention. No major upgrades, no partnerships, no community growth. It’s been stagnant for years. In crypto, silence equals death. The project appears abandoned, with no roadmap, no updates, and no sign of future development.

Next Steps

If you’ve already traded on Mars Ecosystem, withdraw your funds immediately. Don’t wait for a “big move.” There won’t be one.

If you’re thinking of starting, walk away. Use your time and money on platforms with real volume, real support, and real track records. Crypto is risky enough without adding avoidable dangers.

Stick to the big names. Learn from real communities. Build your portfolio on foundations that matter-not on ghosts in the blockchain.

Rachel Thomas

November 26, 2025 AT 23:59Also, USDM? More like USDMYBANKROBBEDME.

Sierra Myers

November 28, 2025 AT 20:24priyanka subbaraj

November 29, 2025 AT 12:30George Kakosouris

December 1, 2025 AT 00:24Meanwhile, the devs are probably sipping margaritas in Bali, laughing as the last 12 idiots still hold XMS thinking it’s ‘undervalued.’

Tony spart

December 1, 2025 AT 21:13imoleayo adebiyi

December 3, 2025 AT 10:33