BTCBIT.NET Fee Calculator

Compare Crypto Purchase Fees

At $100: You'd pay $4.50 in BTCBIT.NET fees, but only $0.50-$3.99 on alternatives. That's $0.50-$4.00 more!

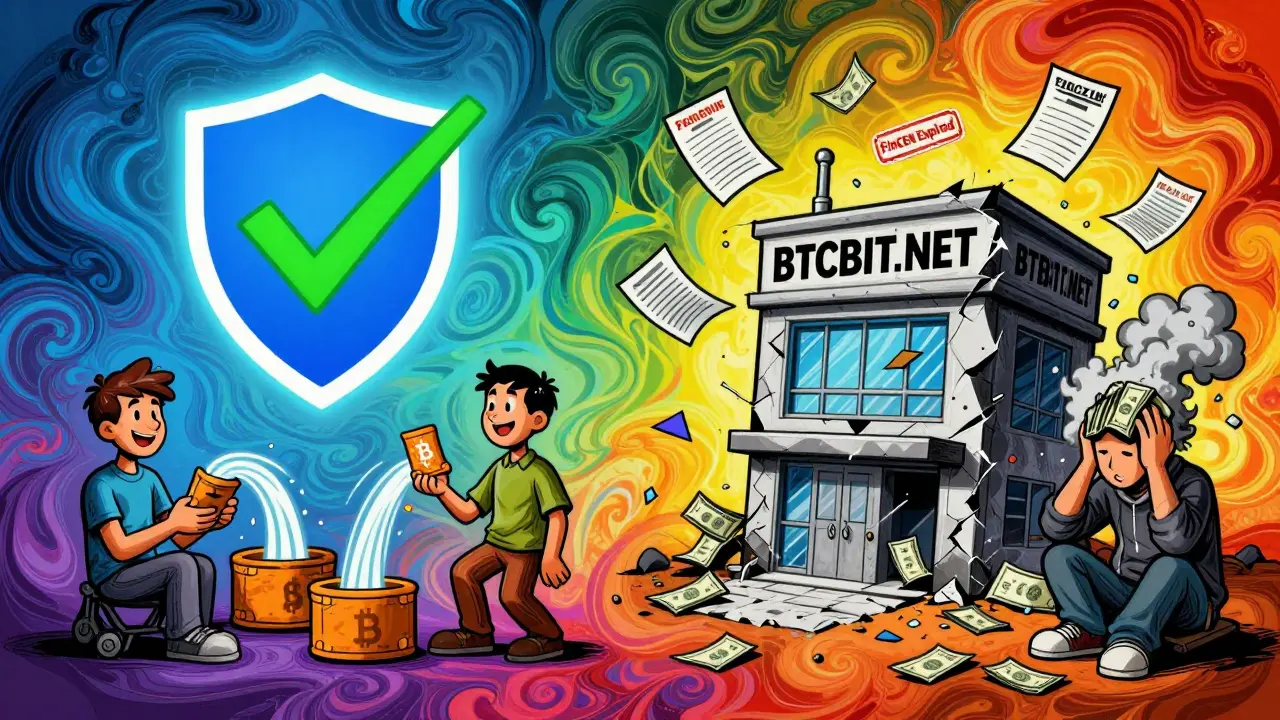

If you're looking to buy Bitcoin or Ethereum with a credit card or bank transfer in the U.S. or Europe, you've probably come across BTCBIT.NET. The site promises fast, simple crypto purchases - no trading skills needed. But here’s the problem: it’s not what it claims to be.

What BTCBIT.NET Actually Does

BTCBIT.NET isn’t a full crypto exchange like Binance or Kraken. It’s a broker. You don’t trade between coins. You give them dollars, euros, or other fiat money, and they send you Bitcoin, Ethereum, or one of 25 other cryptocurrencies. Think of it like a currency exchange booth at the airport - you hand over cash, they hand you foreign money. Simple. But expensive.

They serve 221 countries, including all 50 U.S. states. That’s rare. Most exchanges block U.S. users or limit them to certain states. BTCBIT doesn’t. But that accessibility comes with a cost - literally.

The Fee Problem: 4.5% Is a Lot

Every time you buy crypto on BTCBIT.NET, you pay a 4.5% fee. That’s not a typo. Four and a half percent.

Compare that to Binance, where fees are 0.1% or less. Or Coinbase, which charges around 0.5% to 1% for card purchases. BTCBIT’s fee is nearly 10 times higher than the industry average. For a $1,000 Bitcoin purchase, you pay $45 in fees. That’s like buying a $100 item and getting charged $45 just to process it.

Some users say they’ve seen fees go as high as 8%. The site doesn’t make this clear upfront. You only see the final amount after entering your payment details. That’s not transparency - that’s bait-and-switch.

Withdrawal fees are less extreme. Sending Bitcoin out of BTCBIT costs 0.0006 BTC. That’s about $40 right now, which is in line with current network fees. So at least the withdrawal part doesn’t overcharge you. But the buy-in fee? It’s a red flag.

Regulation: The Biggest Red Flag

BTCBIT.NET claims to be a “fully regulated” exchange. Their website says so. But official records tell a different story.

According to the Estonian Financial Intelligence Unit (MTR), BTCBIT held three registration numbers: FFA000280, FRK000289, and FVR000348. All three are now marked as “Exceeded” or “Revoked.” That means their legal permission to operate as a financial service provider in Estonia - one of their main bases - has been canceled.

They also had a FinCEN registration in the U.S. (number 31000191420776). That one’s expired too. FinCEN is the U.S. agency that tracks money laundering. If you’re not registered with them, you can’t legally serve U.S. customers as a crypto exchange.

So here’s the reality: BTCBIT.NET operates without valid licenses in both Europe and the U.S. That’s not just risky - it’s legally questionable. If they shut down tomorrow, you might not get your money back. There’s no government insurance, no deposit protection.

Security: Basic, But Not Enough

They do offer two-factor authentication (2FA) and store most funds in cold storage. That’s good. Basic security is there. But that’s all. No insurance fund. No proof of reserves. No public audits. No transparency.

Compare that to Coinbase, which keeps 98% of assets in cold storage and insures the rest. Or Kraken, which publishes monthly proof-of-reserves reports. BTCBIT gives you nothing. Just promises.

Customer Support: Fast or Frustrating?

User reviews are split down the middle.

Some say KYC verification took under five minutes. One user on Bestchange.com wrote: “Did KYC + Transfer from Paysafe to Litecoin in 5 minutes.” Another: “Easy and fast, order complete in under half an hour.”

But others report horror stories. One user on Reviews.io said: “I regret to inform you that my experience with this company has been quite disappointing, resulting in the loss of my savings.”

Another on Bestchange.com in July 2022 wrote: “Absolutely rude support... informed only about ‘Wait and keep commission’ without doing any transactions.”

Official support hours are 9 a.m. to 6 p.m. EET, Monday to Friday. But multiple users claim 24/7 live chat is available. That contradiction is a bad sign. If they can’t even agree on their own support hours, how can you trust them with your money?

Who Should Use BTCBIT.NET?

Only one type of person should consider this exchange: someone who needs crypto fast, doesn’t care about fees, and has no other options.

Maybe you’re in a country where no other exchange accepts your payment method. Maybe you’re not tech-savvy and want the simplest possible process. Maybe you’re buying a small amount for a gift or quick experiment.

But if you’re serious about crypto - if you’re buying more than $500, if you plan to hold long-term, if you want to trade later - skip BTCBIT.NET. The fees will eat your profits. The lack of regulation means your funds aren’t protected. And the support is a gamble.

What Are the Alternatives?

If you’re in the U.S., use Coinbase or Kraken. Both are regulated, insured, and charge far less. Coinbase’s card fee is 3.99% - still high, but better than 4.5%. And they’re legally required to follow U.S. rules.

If you’re in Europe, try Bitpanda or Revolut. Both offer low fees, clear regulation, and mobile apps that work smoothly. You can buy crypto with SEPA transfers for under 1%.

And if you’re just starting out, use a non-custodial wallet like Trust Wallet or MetaMask. Buy crypto from a reputable exchange, then move it to your own wallet. Don’t leave it on an exchange - especially not one with revoked licenses.

The Bottom Line

BTCBIT.NET works - technically. You can buy crypto. You can get it fast. The interface is clean. The app works on phones.

But it’s a trap disguised as convenience.

The fees are too high. The licenses are revoked. The support is inconsistent. The security claims are unverified. And there’s no public track record of accountability.

There’s a reason no major financial publication recommends BTCBIT.NET. There’s a reason experts warn against it. And there’s a reason users are losing money.

If you need crypto fast and you’re okay paying a premium, go ahead. But know what you’re risking. And never put more than you can afford to lose.

For most people - especially in the U.S. - there are safer, cheaper, and better options. Use them.

Is BTCBIT.NET a scam?

BTCBIT.NET isn’t a scam in the traditional sense - you can deposit and receive crypto. But it operates without valid licenses in key markets like the U.S. and EU. That’s not illegal everywhere, but it’s high-risk. Many users report lost funds and unresponsive support. The revoked registrations are a major red flag.

Why are BTCBIT.NET’s fees so high?

BTCBIT.NET charges 4.5% because it’s a broker, not a true exchange. It buys crypto wholesale and resells it to you with a large markup. Most exchanges make money from trading volume and lower fees. BTCBIT makes money from the spread and high fees on fiat purchases. It’s a business model built on convenience, not competition.

Can I use BTCBIT.NET in the United States?

Yes, BTCBIT.NET claims to serve all 50 U.S. states. But their FinCEN registration has expired. That means they’re not legally authorized to operate as a money services business in the U.S. You can still use the site, but you’re doing so without regulatory protection. If something goes wrong, the U.S. government won’t step in to help you.

How long does KYC take on BTCBIT.NET?

Some users report KYC completion in under 5 minutes. Others say it takes hours or even days. It’s inconsistent. Fast verification doesn’t mean it’s secure - it just means they’re not checking documents thoroughly. That’s why some users get approved quickly and others get stuck.

What cryptocurrencies does BTCBIT.NET support?

BTCBIT.NET supports 25 cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Ripple (XRP), and Bitcoin Cash. But you can’t trade between them. You can only buy them with fiat money (USD, EUR, etc.). If you want to swap Bitcoin for Ethereum, you’ll need to withdraw and deposit elsewhere.

Is BTCBIT.NET safe for long-term crypto storage?

No. Never store crypto long-term on any exchange, especially one with revoked licenses. BTCBIT.NET uses cold storage, but there’s no proof of reserves, no insurance, and no transparency. If the company shuts down or gets hacked, your funds could disappear. Always move crypto to your own wallet after purchase.

Why do some reviews say BTCBIT.NET is reliable?

Positive reviews often come from users who made small, quick purchases and didn’t run into issues. They got their crypto fast and paid the fee without complaint. But those reviews don’t reflect the long-term risks. Negative reviews - especially about lost funds and unresponsive support - are more telling. Always read the full range of feedback, not just the glowing ones.

Nelson Issangya

December 7, 2025 AT 00:19This site is a walking scam with a pretty UI. I lost $800 trying to buy ETH because their ‘support’ ghosted me after KYC. No license? No insurance? No accountability? You’re not investing-you’re donating to a shell company.

jonathan dunlow

December 7, 2025 AT 13:51Look, I get it-everyone’s scared of fees, but let’s be real. If you’re in a small town with no bank that supports crypto, and you need Bitcoin NOW for a friend’s birthday or to pay someone overseas, BTCBIT is the only thing that works. Yeah, 4.5% sucks, but it’s cheaper than wiring money through Western Union and waiting 3 days. I’ve used it three times for small buys under $200. Didn’t lose anything. Maybe the haters just got unlucky or tried to move too much too fast. Don’t throw the baby out with the bathwater-just don’t park your life savings there.

Chris Mitchell

December 7, 2025 AT 14:28Regulation isn’t about trust-it’s about recourse. No license = no legal recourse. That’s not opinion. That’s law. Stop romanticizing convenience.

rita linda

December 7, 2025 AT 22:33U.S. users need to wake up. This is why we can’t have nice things. You let these offshore shell ops exploit loopholes, then you cry when your funds vanish. FinCEN revoked their registration because they were laundering through prepaid cards and fake IDs. You think that’s a coincidence? No. You’re the market they prey on. Stop feeding the beast.

Martin Hansen

December 8, 2025 AT 02:224.5%? Bro, that’s a discount compared to what I paid on Coinbase last year. And at least BTCBIT doesn’t make you jump through 17 KYC hoops just to buy $50 of BTC. If you’re too lazy to use a real exchange, don’t act like you’re morally superior. You just want it easy-and that’s fine. But don’t pretend you’re ‘smart’ for avoiding it. You’re just cheap.

Scott Sơn

December 9, 2025 AT 05:28Imagine walking into a casino where the dealer says, ‘Hey, I’m not licensed, but I’ll let you bet your rent money on red.’ And you do it. Because it’s ‘fast.’ And then you’re sobbing in the alley at 3 a.m. wondering why you trusted a guy with a Bluetooth headset and a website that looks like it was built in 2012. That’s BTCBIT. It’s not a platform. It’s a trapdoor with a loading screen.

Sandra Lee Beagan

December 9, 2025 AT 18:11I’m from Canada, and I used this once to send crypto to my sister in Mexico-she doesn’t have a bank account. It worked. Took 7 minutes. Fee was 4.5%, but I didn’t have options. I don’t recommend it for long-term, but sometimes you need a bridge, not a mansion. Just don’t live there. 🤝

Ben VanDyk

December 10, 2025 AT 18:22‘They serve 221 countries.’ That’s not a feature. That’s a red flag. Legit exchanges geo-block regions for compliance. This one doesn’t because it doesn’t care. Grammar check: ‘You give them dollars... they send you Bitcoin.’ Should be ‘you give them dollars... they send you *some* Bitcoin.’ Minor, but tells you they don’t care about precision. Neither should you.

Barb Pooley

December 11, 2025 AT 06:15What if this is all a front for a government surveillance operation? I mean, why would a company with revoked licenses still be online? Why do they even have a working app? They’re harvesting wallet addresses, KYC data, and IP logs. They sell it to the NSA or some dark web broker. I’ve seen the patterns. They’re not trying to make money-they’re trying to map the entire crypto network. Don’t be the data point.

Shane Budge

December 11, 2025 AT 08:01How many users actually lost money vs. just complained about fees?